Optimal Market Breadth

If you trade US stock index futures, you’ve probably come across market breadth. The most well-known breadth measure is the Advance-Decline line, which is the cumulated difference between the number of advancing and declining stocks on the NYSE. This metric is often used to gauge wider market sentiment.

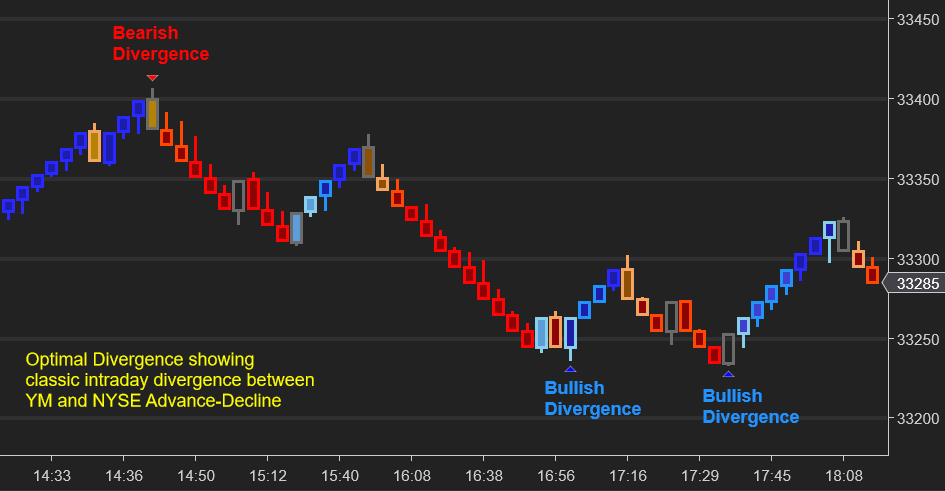

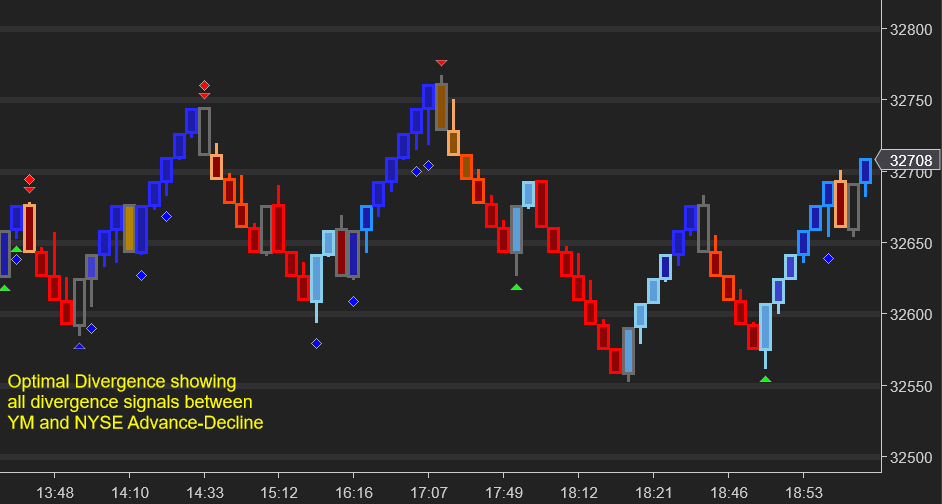

Optimal Market Breadth synchronizes

Optimal Renko Bars

with Advance-Decline data and checks for areas of mismatch in three market breadth conditions. These are then plotted direct to the bars so that you can easily see breadth divergence without having to watch other panels.

Optimal Market Breadth

If you trade US stock index futures, you’ve probably come across market breadth. The most well known breadth measure is the Advance Decline line, which is the cumulated difference between the number of advancing and declining stocks on the NYSE. This metric is often used to gauge wider market sentiment.

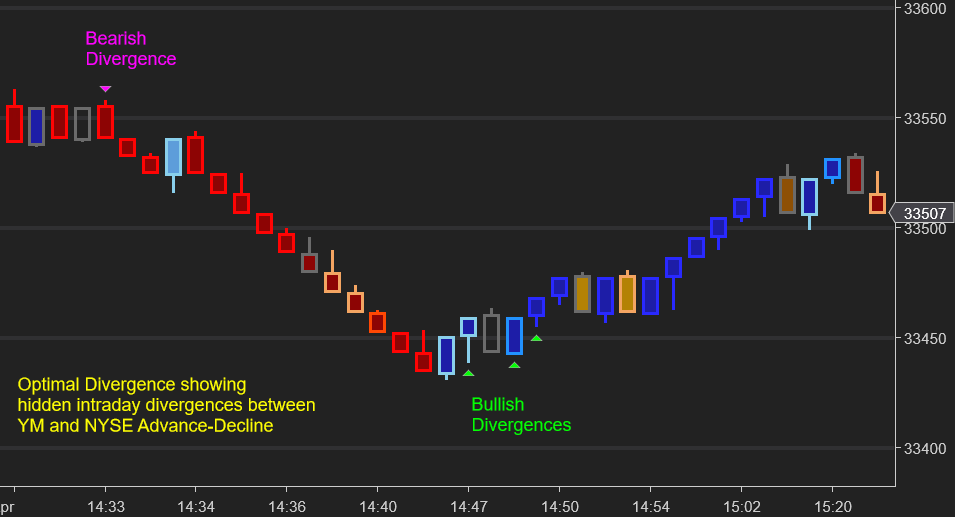

Optimal Market Breadth synchronizes

Optimal Renko Bars

with Advance Decline data and checks for areas of mismatch in three market breadth conditions. These are then plotted direct to the bars so that you can easily see market breadth divergence without having to watch other panels.

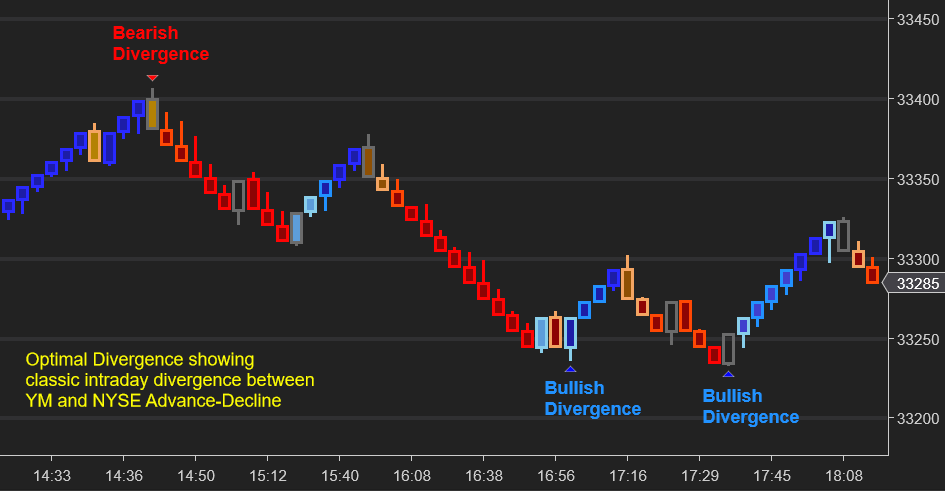

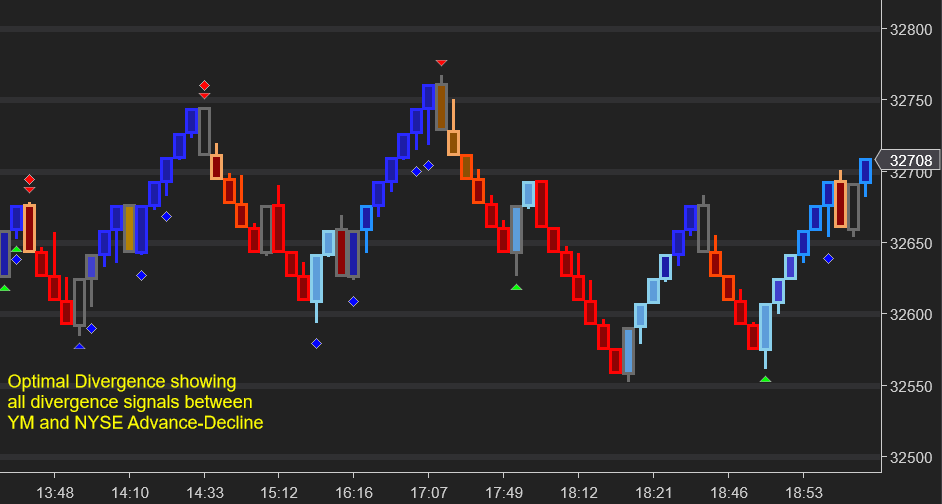

Classic Divergence

This marks when price makes a new intraday high/low but Advance-Decline does not make a new high/low. This would suggest that the move has not been supported by the wider market. This can help highlight potential turning points.

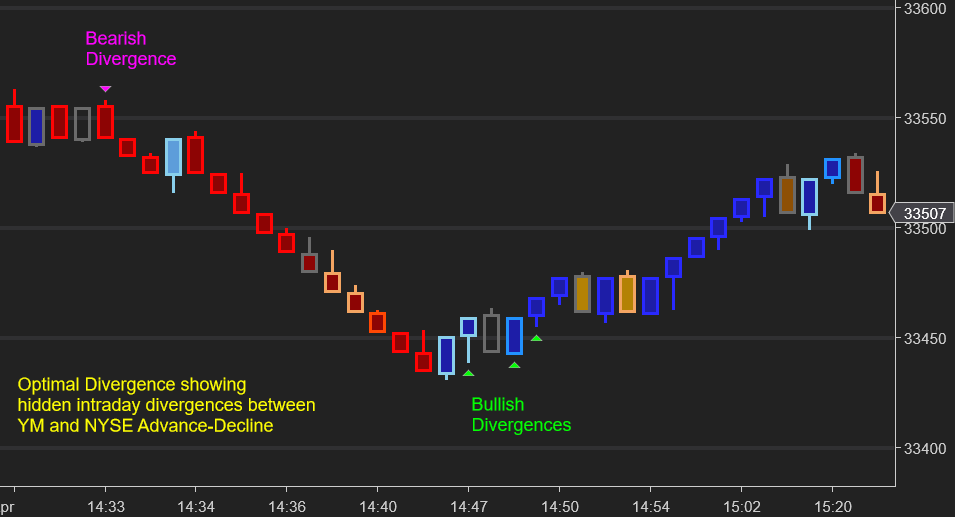

Hidden Divergence

Marks when Advance-Decline makes a new intraday high/low but price does not make a new high/low. This would suggest that extreme sentiment in the wider market has not been reflected in the futures contract, and can also flag potential turning points.

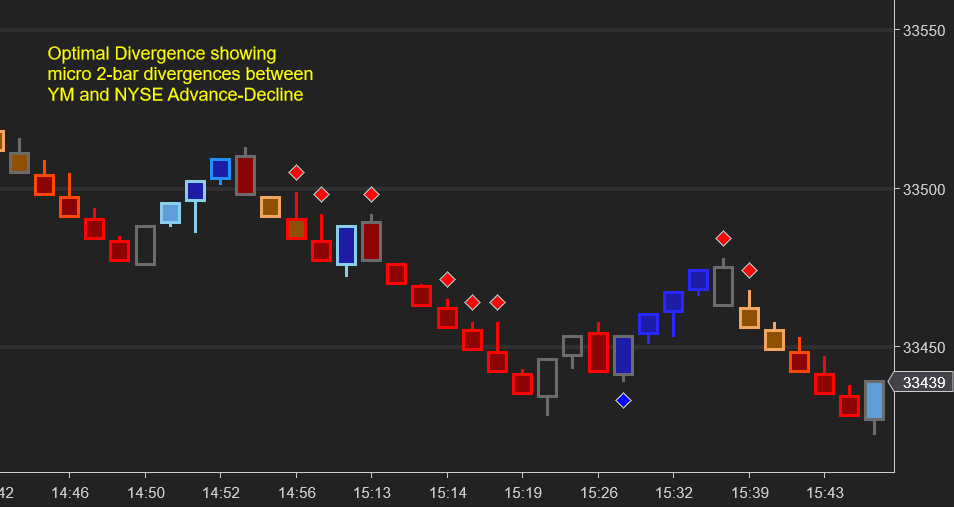

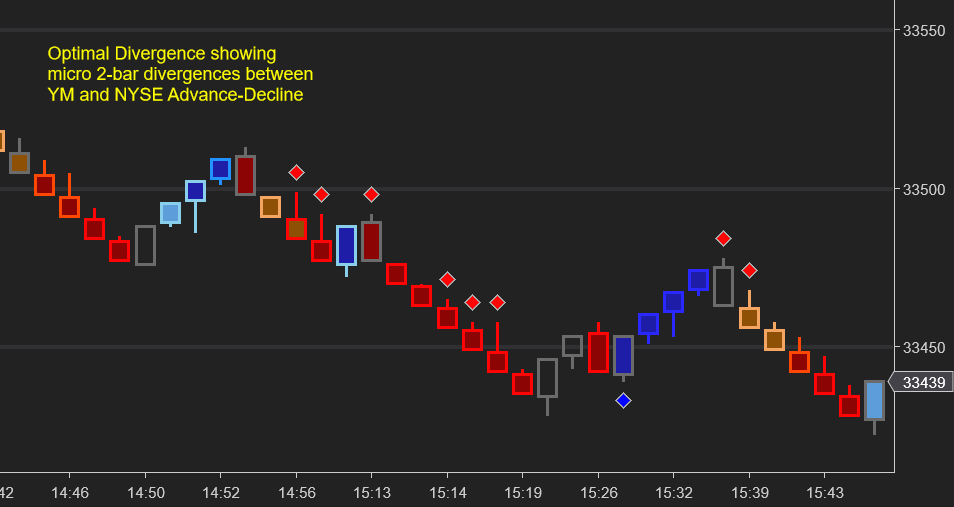

Micro Divergence

This checks for hidden and classic divergence conditions across the last two closed bars, rather than at intraday highs/lows. This can help with scalp entries and short-term inflection points.

Breadth divergences should never be a single entry condition but can provide create powerful supporting evidence when viewed in context. They are most useful when the market is in intraday cycling mode and breaking/testing round number levels.