Strategy Building with Optimal Ninja

Strategy Building with Indicators Pack

It's simple to build strategies with Optimal Indicators pack.

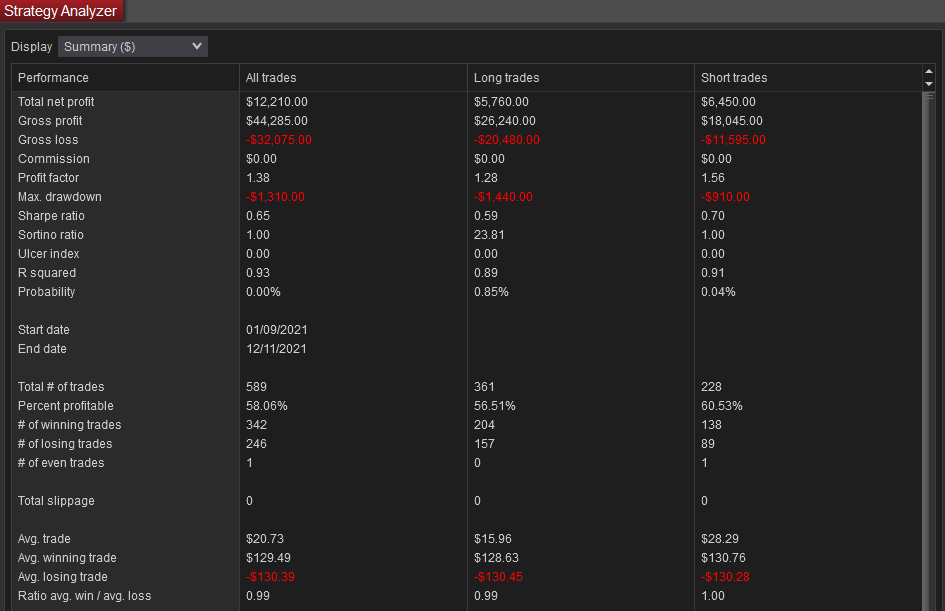

As an illustration, we spent a couple of hours building a simple intraday trading strategy for the previous two months of YM (1st September to 12th November) using real open Optimal Renko bar patterns and Optimal Vision point of control as support / resistance.

We used Strategy Builder only (no bespoke coding was allowed) and the goal was to create a trading strategy that was profitable in both long and short trades, to eliminate the effect of market directional bias.

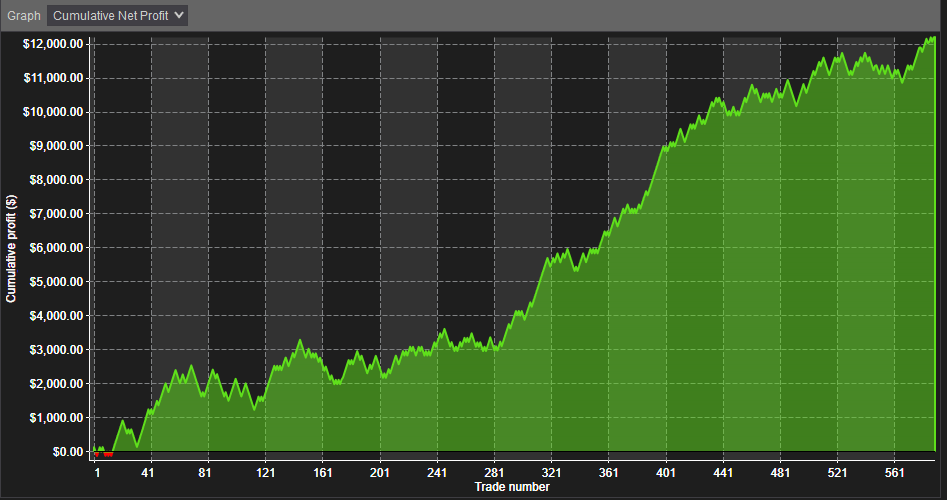

The initial results were encouraging:

Results are hypothetical. One contract traded. Slippage and costs are not included. These screenshots are only intended to illustrate the strategy builder compatibility of our products. Your strategy results may not emulate ours. There are inherent limitations in backtesting. The strategy is not included with a subscription.

This is a relatively crude model and would require further development and testing before becoming a tradable system, but is shown as an example what is possible using only simple outputs from just two of our products without coding.

Liberate and build your trade ideas

All of our indicators can be automated.

Want to build pivot level strategies using Optimal Pivots

backtested statistics? No problem. You can test for whether price is above or below any pivot level and whether it has been previously touched in the session. You can call percentage touch rates and percentage close rates for any pivot in a session, and for the prior session high, low and close.

Interested in market breadth divergences? Optimal Market Breadth

makes it simple to incorporate these into your strategy building.

Using non-time bars? Optimal Speed

can test for slow bars, crawl bars and the slowest up/down bars of the session. Optimal Tempo

can integrate minute bar timeframe levels into your testing.

Huge flexibility. Endless scope to explore your trade ideas.

Tips for successful strategy building

A vast amount has been written about building and testing trading strategies. These are our top three tips:

1. Observations based on conjecture and experience and confirmed through testing are usually sound

It is much better to start with a theory of market behaviour that sounds reasonable, and to confirm with testing, than to uncover an apparently magical edge through optimization. Optimized results that are not underpinned by logical reasoning may simply be revealing random parameter fitting.

2. Fewer rules result in a more robust outcome

Traders often add complexity in the search for certainty. In discretionary trading, this usually results in charts that look like a Jackson Pollock painting. In automated trading, it increases the chance of curve fitting. Both result in adverse outcomes. We recommend four or fewer variables in a strategy.

3. More test data is better

Testing over a longer time period will include more market modes: trending, wide-amplitude cycles, low volatility and price shocks.

Build your strategy with Optimal Ninja!