Optimal Renko Bars

If you’ve traded with renko bars in the past, you know their unique ability to filter market noise.

But

you soon discover that the

best brick size for your market changes

from session to session, even hour to hour.

What worked beautifully in yesterday’s trend move finds you stuck in a tight cyclical market today with few opportunities, and poor risk-reward. This can mean either standing aside completely, or taking low quality trades. Frustrating.

One approach to overcome this has been to take a percentage of yesterday’s Average True Range (ATR), say 10%, and use that for the today’s brick size. There are three problems with this approach:

- The percentage applied is arbitrary

- It is still essentially fixed; it doesn't adapt to today's market

- It doesn’t tell you what the best bar size actually was

The challenge of renko bars

If you’ve traded with renko bars in the past, you know their unique ability to filter market noise.

But you soon discover that the best brick size for your market changes from session to session, even hour to hour.

What worked beautifully in yesterday’s trend move finds you stuck in a tight cyclical market today with few opportunities, and poor risk-reward. This can mean either standing aside completely, or taking low quality trades. Frustrating.

One approach to overcome this has been to take a percentage of yesterday’s Average True Range (ATR), say 10%, and use that for the today’s brick size. There are three problems with this approach:

The percentage applied is arbitrary

It is still essentially fixed; it doesn't adapt to today's market

It doesn’t tell you what the best bar size actually was

Our solution

At Optimal Renko we believe that asking better questions yields more insightful answers.

Rather than accepting standardized charting models, we sought an answer to the following:

1. Which bars give the smoothest chart?

2. Which bars yield the best trading opportunities?

The objective? To build a bar type that adapts to what is happening now, not yesterday.

Our solution

At

Opimal Ninja we believe that asking better questions yields more insightful answers.

Rather than accepting standardized charting models, we sought an answer to the following:

1. Which bars give the smoothest chart?

2. Which bars yield the best trading opportunities?

The objective? To build a bar type that adapts to what is happening now, not yesterday.

No repainting. Historical bars match real time.

With real, not synthetic, opens for greater confidence in back-testing.

Logic meets opportunity

Our proprietary algorithm analyses and weights key metrics of market session behaviour and then checks that there is likely to be sufficient intraday trading opportunity before it selects the ideal bar. In this way, bar-size selection combines science with practicality.

Choose Swing or Scalp Mode

Set the bars to the mode that fits your trading style and personality. Use Swing Mode

for larger intraday moves or Scalp Mode

for faster setups. Or use both, side by side! Both modes employ the same noise filtering technology, attuned to different time-frames, so you're never short of trading opportunities in a session.

Using

Optimal Renko Bars

you can be assured that the cognitive bias inherent in manually choosing a renko brick size is removed from your charts, and that you are viewing your market in a way not common to other participants.

Still using fixed brick sizes? See what smart-sizing can do!

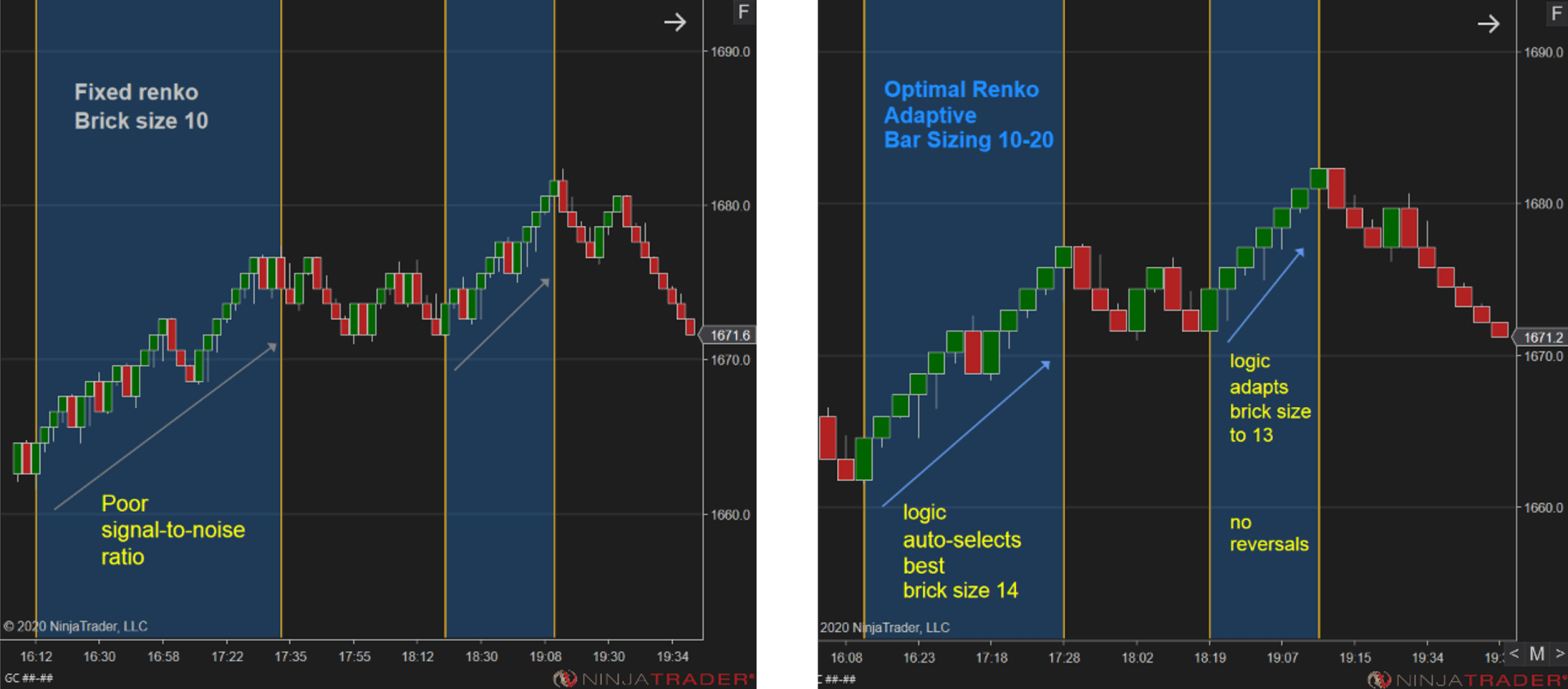

Take a look at how our intelligent bar-sizing algorithm helped with trading gold futures.

If you were using the popular brick size of 10 ticks, you’d have to fight your way through a forest of reversal bars to stay long through the first blue section. Not so with Optimal Renko. Being able to compute the best-fit bars as the session unfolds, the logic auto-selected a brick size of 14, making it much easier to stay on-trend. In the second uptrend, the logic switches to a bar size of 13, ensuring no reversal bars at all on that 7 bar move.

Previously, this ‘best’ brick size could only be found in hindsight. Now you can apply it straight onto your chart, as it happens.

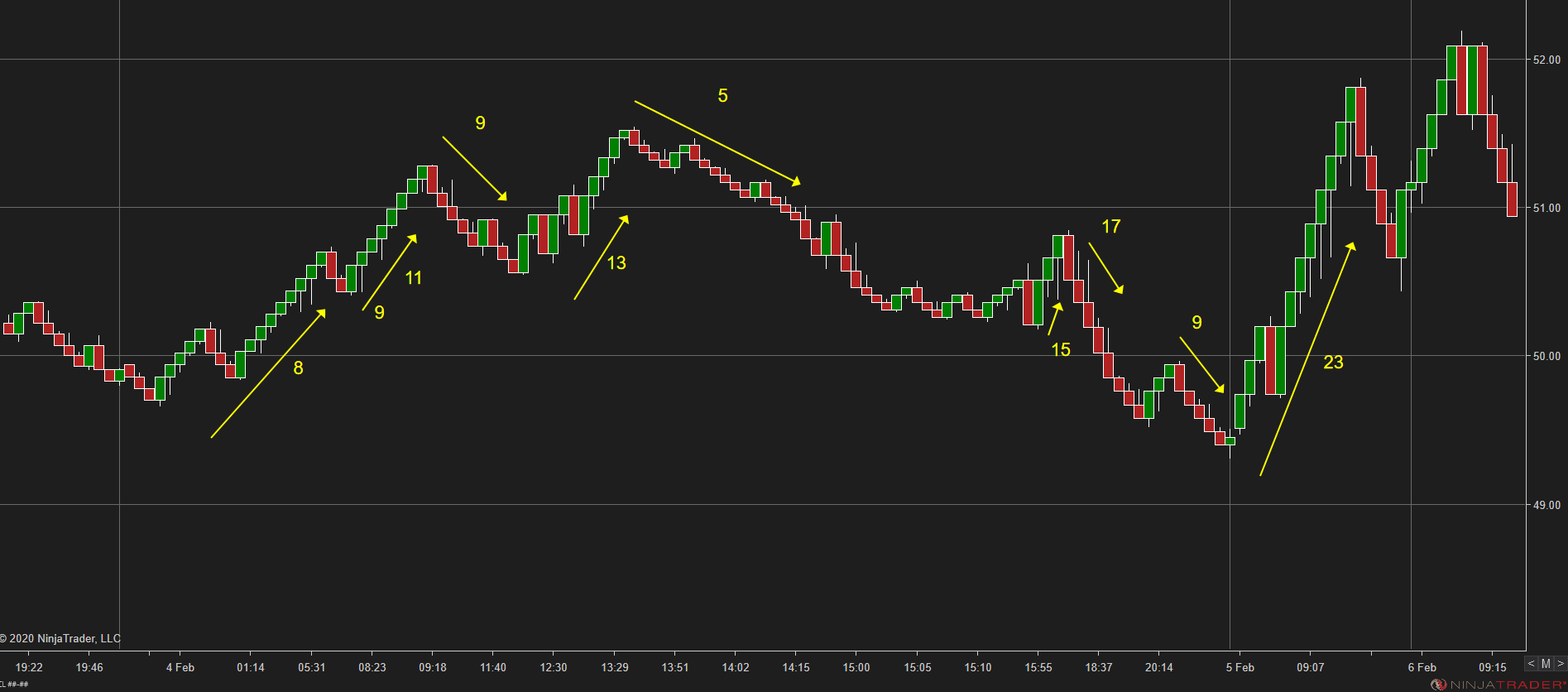

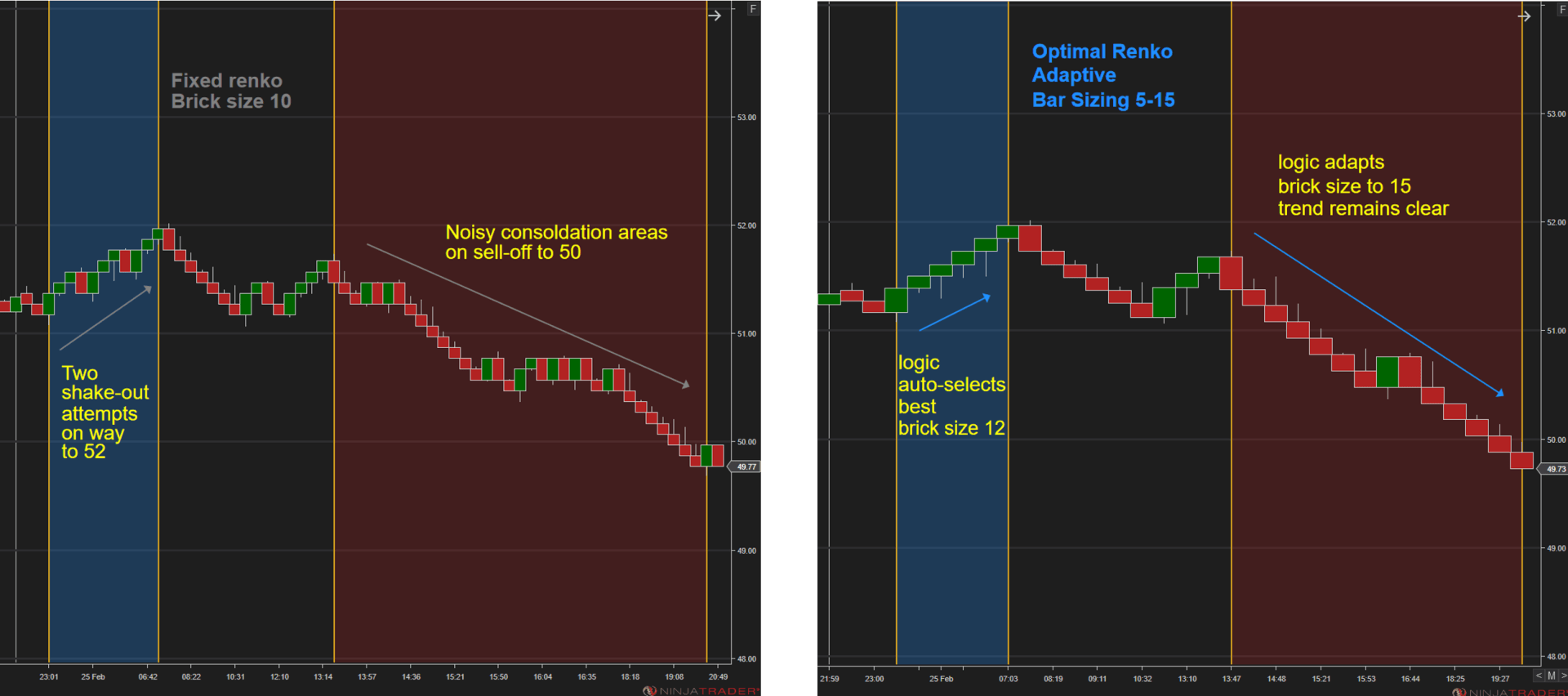

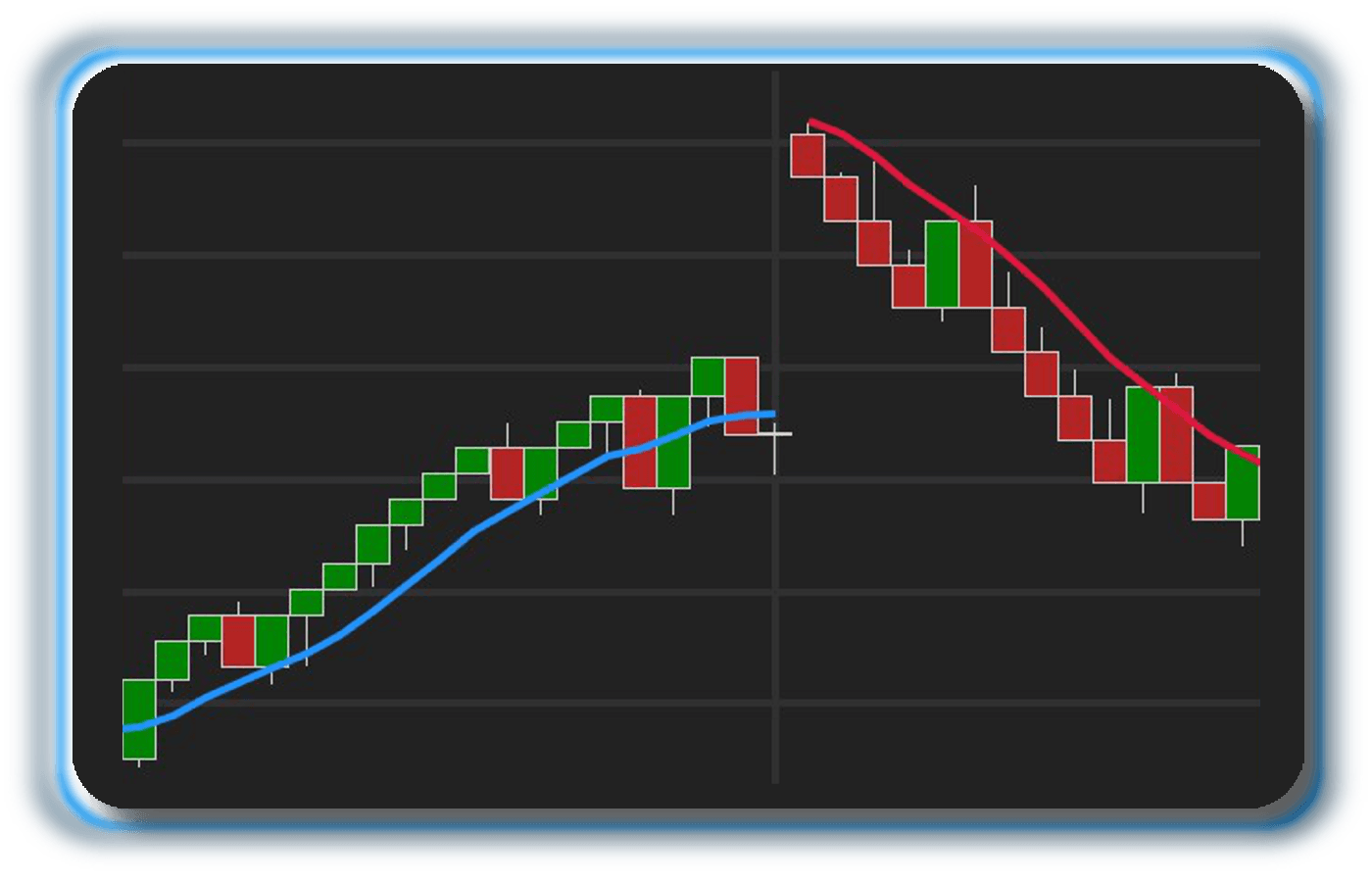

How about this session in crude oil?

Optimal Renko Bars

easily beat a fixed setting of 10 in this session of CL. Our software removed the many extraneous reversal bars on the chart to keep you on-trend. Hold open trades longer, reduce costly re-entries.

Smart | Adaptive | Real time

Logic meets opportunity

Our proprietary algorithm analyses and weights key metrics of market session behaviour, and then checks that there is likely to be sufficient intraday trading opportunity before it selects the ideal bar. In this way, bar-size selection combines science with practicality.

Using

Optimal Renko Bars

you can be assured that the cognitive bias inherent in manually choosing a renko brick size is removed from your charts, and that you are viewing your market in a way not common to other participants.

Choose between Swing Mode or Scalp Mode

Set the bars to the mode that fits your trading style and personality. Use Swing Mode

for larger intraday moves or Scalp Mode

for faster setups. Or use both, side by side! Both modes employ the same noise filtering technology, attuned to different time-frames, so you're never short of trading opportunities in a session.

Still using fixed brick sizes? See the power of smart-sizing!

Take a look at how our intelligent bar-sizing algorithm helped with trading gold futures.

If you were using the popular brick size of 10 ticks, you’d have to fight your way through a forest of reversal bars to stay long through the first blue section. Not so with Optimal Renko Bars. Being able to compute the best-fit bars as the session unfolds, the logic auto-selected a brick size of 14, making it much easier to stay on-trend. In the second uptrend, the logic switched to a bar size of 13, ensuring no reversal bars at all on that 7 bar move.

Previously, this ‘best’ brick size could only be found in hindsight. Now you can apply it straight onto your chart, as it happens.

How about this session in crude oil ?

Optimal Renko

Bars

easily beat a fixed setting of 10 in this session of CL. Our software removed the many extraneous reversal bars on the chart to keep you on-trend. Hold open trades longer, reduce costly re-entries.